- Get link

- X

- Other Apps

Its dependent on a landslide of factorsyour income debt and responsibilities mainlyexperts agree its possible to save money for a house in a year. Perhaps the most important of home buying costs is the down payment.

10 Easy Ways To Save For A House Moving Com

10 Easy Ways To Save For A House Moving Com

Cushman Associate Professor of Business at.

/tips-for-buying-your-first-home-d7a39189c9dd4bc39e6de466a343450b.png)

Steps to saving for a house. If you are saving for a home you need to take advantage of every possible opportunity to earn extra money. Determine Your Total Mortgage Amount. Take It Straight Out Of Your Pay.

If you want to buy a house in the near future that means building up some serious savings. Save 10 to 20 for the Down Payment. Now to be clear savings accounts arent going to make you rich.

Cut back on non-essentials. Tips for Saving For A House. According to Michaela Pagel Roderick H.

Here are five essential steps to save for buying a house. Table of Contents Our 5 Step Guide To Saving For A House Fast. Build A Better Budget.

If you dont know where your money goes. Set Up an Emergency Fund. In the bible God says to honor the Lord with the first fruits of all your crops.

Here are 10 simple steps to help you do just that. In truth take advantage of various digital tools or apps to create a. Open a Savings Account.

Figure out if you are financially prepared to be a homeowner. One of the best ways to save for a mortgage is to consider cutting back on everyday expenses like gym memberships magazine subscriptions streaming services or. How to Start Saving for a House Breaking Down the Costs.

Make a budget and track your spending. Save enough of these little amounts and it all adds up. Here well share some of our best advice for saving for a home whether its your first home or youve purchased a home before.

Create a monthly budget. How To Save Money For A House 1. This is a lesson I learned at church.

The home buying checklist is a long one and coming up with the money for a down payment on a housethe initial deposit you make on your propertyis no small effort. If you find yourself in a similar situation and are wondering how you can save up for a house too here are five steps for saving for a house. Taking control of your monthly expenditure is the best way to manage your household finances.

Make sure your budget is achievable youre likely get more out of 12 months of moderate savings than 12 days of big savings. And one of the best ways to do that is by putting your savings into an account that earns a decent amount of interest. Decide What Kind Of House.

What the bank may say you can afford might be drastically different from what you can actually afford. No one wants to hear it but having a budget and actually sticking to it is the key to quickly saving money for a house. Your Big Savings Goal.

If you can save a similar amount to what you expect your home loan repayments will be that can help you budget over the longer term. Divide that amount by your savings goal for your upfront housing costs and youve got the number of months between today and home ownership. Find out the total amount of money you need to buy a house including the down payment and closing costs.

Calculate your total home costs including mortgage property taxes and home. Decide on Your Budget. Prior to even looking at homes decide what amount you can comfortably afford.

Calculate How Much You Can Afford to Pay Monthly. A personal budget is a financial statement that allocates your monthly income towards savings debt repayments and savings. Look at your current income and expenses and determine how much you could squirrel away each month.

The first step in the saving process is budgeting. So be smart with your money by saving on the things that dont concern you and putting the extra saving aside for your home loan. More quick tips for how to save for a house Ask for a raise Instead of buying books apply for a library card Use coupons Take advantage of discounts and deals at local restaurants Work on improving your credit score Use money saving mobile apps Have a friend of family member keep you accountable.

When youre saving for a home its important to have a place where you can actively set aside money that you intend to put towards the down payment. You build savings by. Pay Debts Before Purchasing a House.

You should be working through these ten steps as you save money for your house. Set a realistic goal for when you would like to buy a house. This cant be your ordinary easy to accomplish budget either.

Get on top of your debts. Cut Out Non-Essential Expenses. Thats a huge motivator for saving.

Determine if buying a house is the right financial decision. Heres how you can save money to buy a house. How to Save for a House in 6 Month 1.

Our 5 Step Guide To Saving For A House Fast

Our 5 Step Guide To Saving For A House Fast

5 Tips To Help You Save For A House In 6 Months House Down Payment Buying First Home Best Money Saving Tips

5 Tips To Help You Save For A House In 6 Months House Down Payment Buying First Home Best Money Saving Tips

How To Save Money To Buy A House In 7 Simple Steps

How To Save Money To Buy A House In 7 Simple Steps

Saving For A Downpayment On A House Buying First Home First Home Buyer Home Buying Process

Saving For A Downpayment On A House Buying First Home First Home Buyer Home Buying Process

Saving For A House Here S The 12 Steps To Affording A Down Payment

Saving For A House Here S The 12 Steps To Affording A Down Payment

9 Steps To Saving For A Down Payment On A House

Our 5 Step Guide To Saving For A House Fast

Our 5 Step Guide To Saving For A House Fast

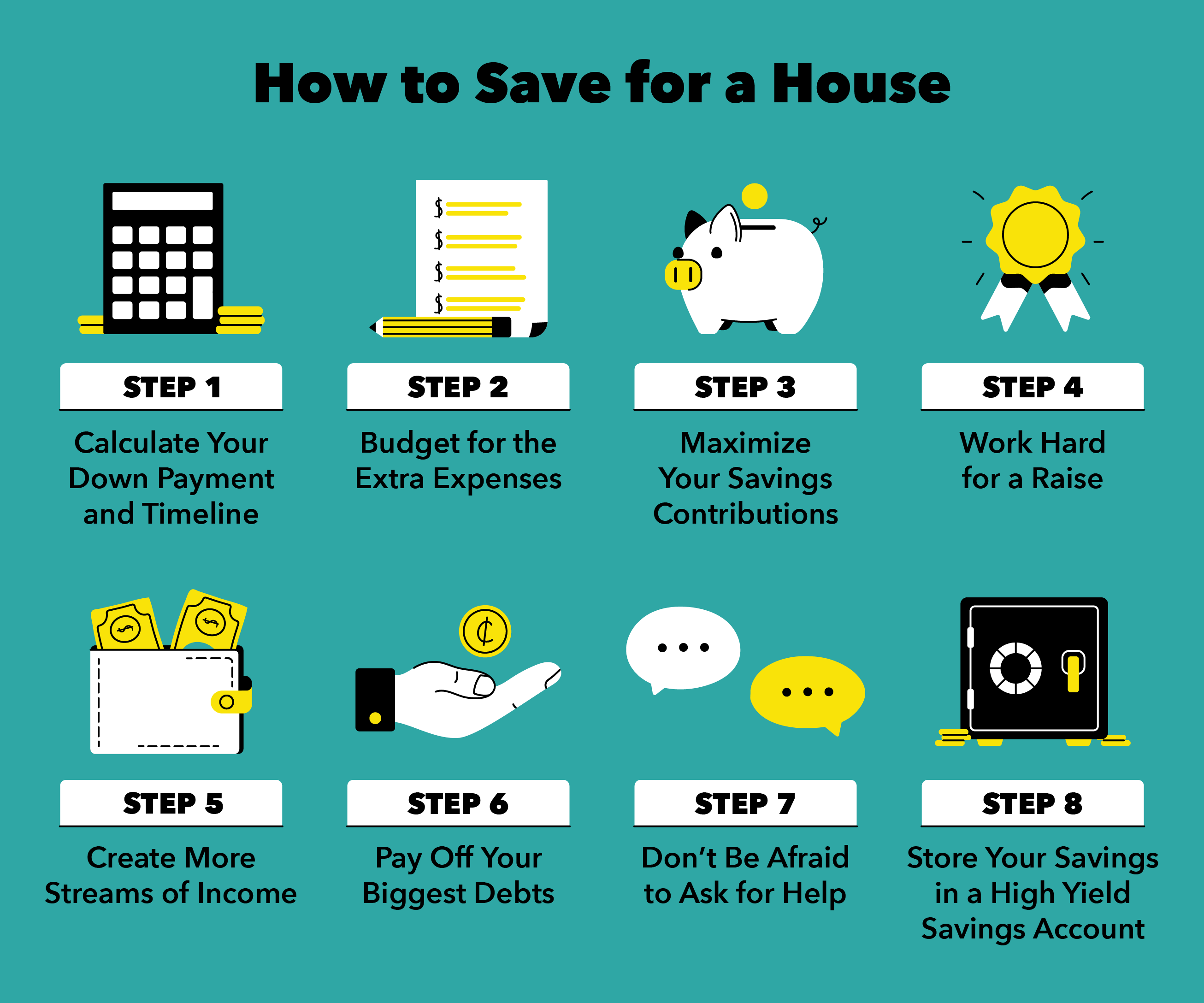

How To Save For A House In 8 Steps

How To Save For A House In 8 Steps

How To Save A Down Payment For A House Ramseysolutions Com

How To Save A Down Payment For A House Ramseysolutions Com

Saving For A House Here S The 12 Steps To Affording A Down Payment

Saving For A House Here S The 12 Steps To Affording A Down Payment

How To Save For A House In 8 Steps

How To Save For A House In 8 Steps

/tips-for-buying-your-first-home-d7a39189c9dd4bc39e6de466a343450b.png) 9 Basic Steps To Buy Your First Home

9 Basic Steps To Buy Your First Home

5 Steps For Saving For A House Payoff Life

5 Steps For Saving For A House Payoff Life

Comments

Post a Comment