- Get link

- X

- Other Apps

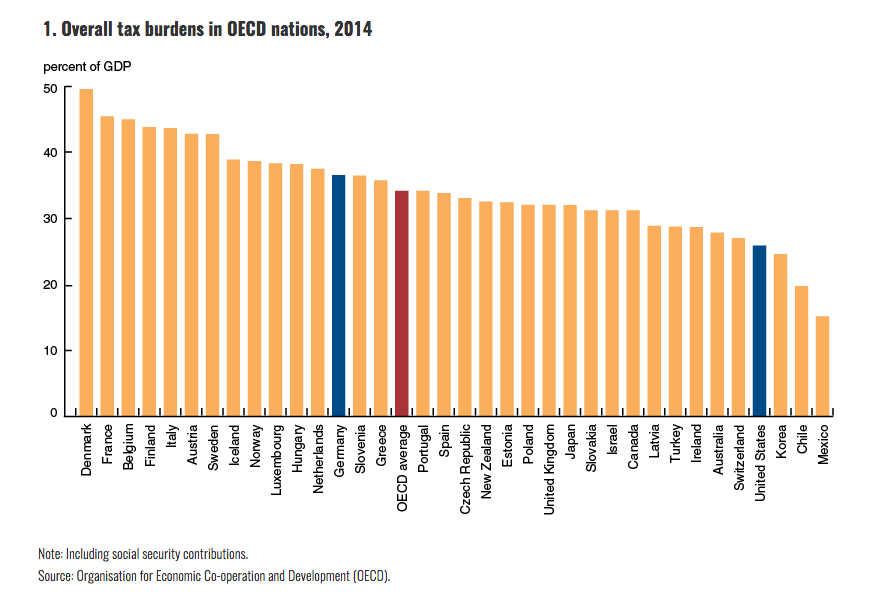

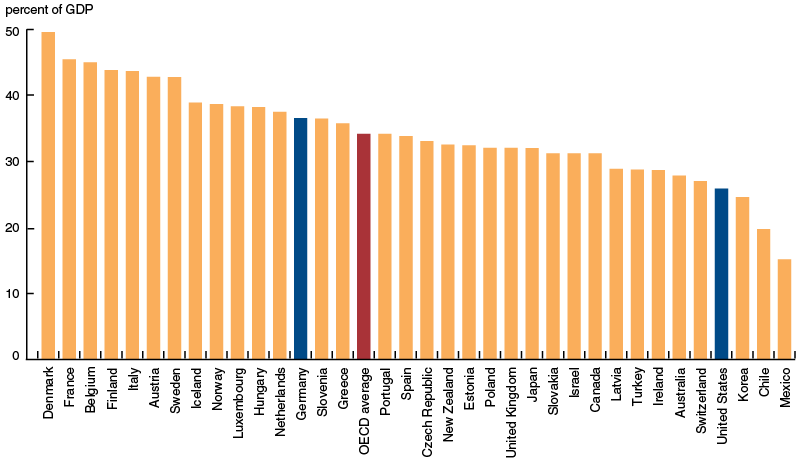

22 more than Germany Tax rates. Several European countries tax in excess of 40 of GDP including France Denmark Belgium and.

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The tax year in Germany matches that of the US - the calendar year of January 1 thru December 31.

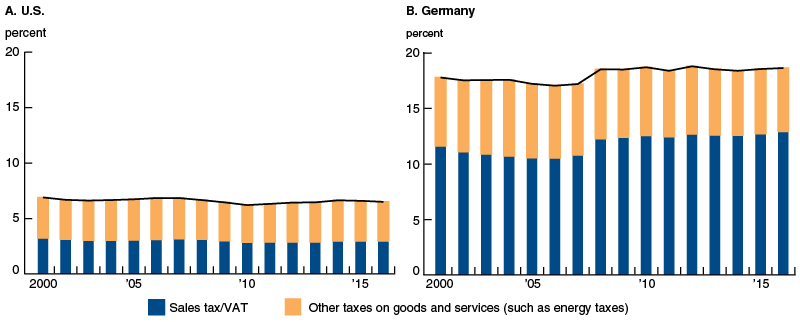

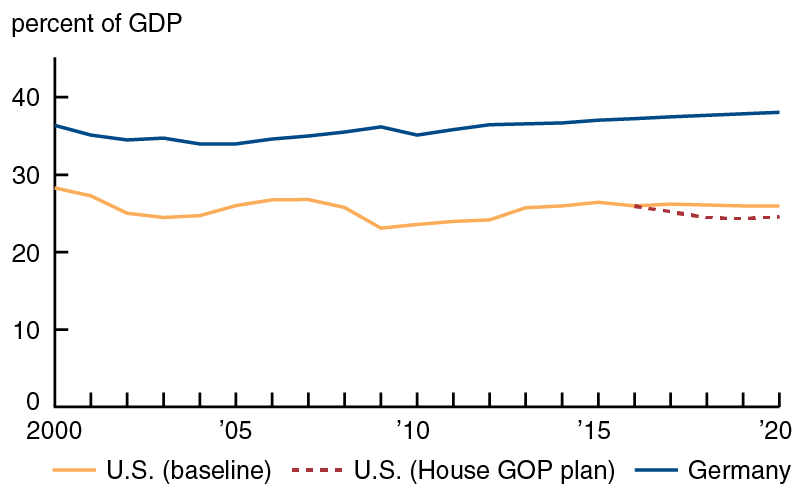

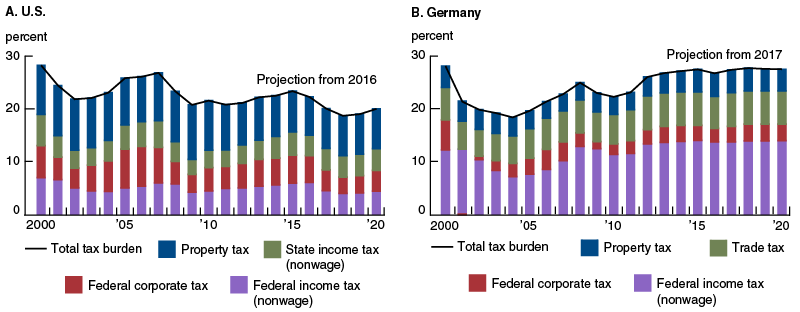

Taxes in germany vs usa. The reason for that is the fact that the USA tax their citizens regardless of their actual residence since Germany taxes individuals with their worldwide income if they are resident in Germany. The president of the united states transmitting the convention between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes together with a related protocol signed at bonn on august 29 1989. The average for other member countries of the Organisation for Economic Co-operation and Development OECD is about 34.

German income tax rates are relatively high compared to the US so for many people it will make sense to claim the Foreign Tax Credit. For obvious reasons this makes things a bit more convenient since both German and United States taxes can be filed at the same time. The Tax Policy Center looked into the matter in 2018 and found that US.

Taxes represent about 243 of the countrys gross domestic product GDP. 227 sor A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in. 70 sor 29 more than United States 35 Ranked 35th.

South Korea - 6575. 78 more than United States 1591 Ranked 3rd. When as a single woman with no dependent children I was diagnosed with cancer 9 years ago I lost my job had to file bankruptcy due to medical.

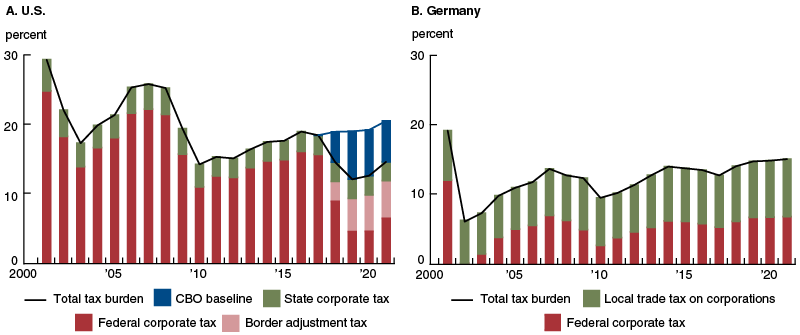

Figures based upon 1 USD 070707506 GBP. South Africa - 6178. Corporations actually get stuck paying the maximum nominal 35 rate instead paying about 20 on average.

A household income of 100k will give you a net salary of 67k in San Francisco some answers here ironically only include federal tax 1 A household income of 100k 88k will give you a ne. I lived on the west coast east coast and now the south. Figures based upon 1 EUR 086026315 GBP.

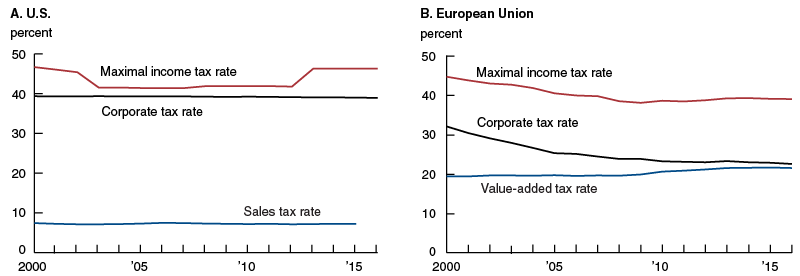

In the United States the top rate is 434 starting at 406750 USD for a single person and would be as high as 567 if the income was earned in California. Such conflict occurs for example when the German tax administration classifies an LLC as a corporation for tax purposes while the LLCs shareholders have opted for being qualified as a partnership for US tax purposes. Hello Mariah as a German who has lived in the USA for 18 years now I experienced one live changing difference between Germany and America.

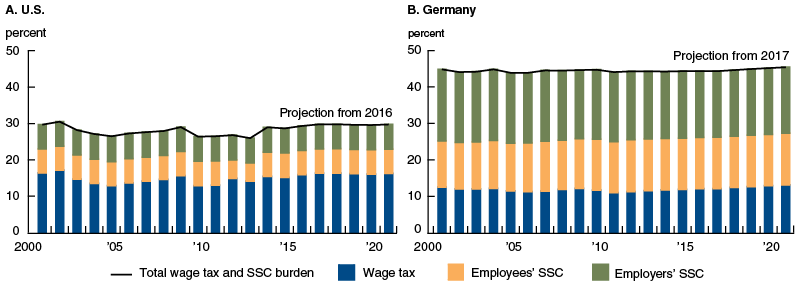

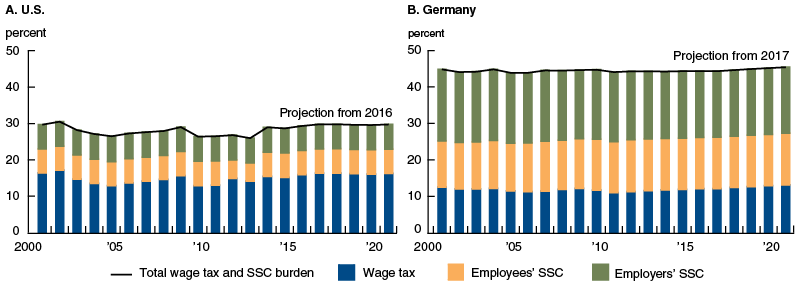

7 Second in the United States consumption labor income and capital income that is business and property income all face a lower tax burden than in Germany. Alongside income tax there is also a solidarity tax of a maximum of 55 of the income tax you owe. If a US citizen is resident in Germany he or she always face a potential double taxation scenario.

Is a relatively lightly taxed country with an average tax burden that is lower than Germanys by more than 10 of GDP. In some places USA taxes are higher than in Germany. As it happens deductions and other tax strategies mean relatively few US.

In Germany the top tax rate is 505 which starts at 283326 USD for a single person. Tax payments Number. When Are German Taxes Due.

Corporations are in fact paying higher income taxes than German ones. According to the USGerman Tax treaty under 19VA disability compensation is not taxable in Germany. However under 23 of the tax treaty it states that Germany will take the amount of income that falls under 19and apply or use it to arrive at the total amount of taxable income under the German tax code.

In Germany an income of 3487305 EUR 3000000 GBP is more than the lowest average advertised salary of 1890000 EUR 1625897 GBP and less than the countrys average income of 4300000 EUR 3699132 GBP. United States - 6045 based on New York state tax Germany - 6061. If a taxpayer has a residence in Germany they must submit an unrestricted return.

So in other words the German. USA A deviating classification by the German tax administration can hence result in a so-called conflict of qualification. German income tax rates range from 0 to 45.

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Question Of The Day Order These Countries From Highest To Lowest Tax Rates United States Germany Mexico Blog

Question Of The Day Order These Countries From Highest To Lowest Tax Rates United States Germany Mexico Blog

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Federal Ministry Of Finance Taxes An International Comparison

Federal Ministry Of Finance Taxes An International Comparison

Compare Your Pay After Averaged Taxes To Other Developed Nations Pbs Newshour

Compare Your Pay After Averaged Taxes To Other Developed Nations Pbs Newshour

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

How Do Us Taxes Compare Internationally Tax Policy Center

How Do Us Taxes Compare Internationally Tax Policy Center

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Comments

Post a Comment