- Get link

- X

- Other Apps

How do I take legal action against a bank. The FSP has 45 days to respond to the dispute before you can escalate it to EDR.

Scammers purchase them in the same exact way.

How to take legal action against bank. Legal Action letters can be formal letters that are written by a lawyer on behalf of the client demanding payment or some other action from another party and written by one individual to another demanding payment. The key is to obtain a judgement in which the judge agrees your bank has breached its statutory duty. The Human Rights Act states that only the victim of a human rights breach can take legal action under the Act.

Banks may freeze bank accounts if they suspect illegal activity such as money laundering terrorist financing or writing bad checks. They will have a policy in place to deal with fraud. The person must make a file with the relevant documents attached to it.

Kickstart the autodialer software. A demand letter is a formal business letter. Interest groups and charities cannot take legal action themselves unless they meet the victim test.

In essence fraudsters take the following five steps to secure a favorable outcome. The account holder can visit the nearest bank branch and fill up a designated form for updation of customer details. Self-attested copy of PAN or Form 60 shall be attached to the form and submitted.

How to Get Legal Help With Filing Consumer Complaints Against a Bank. If you have sent money through another bank or transfer service its a good idea to contact the service you used. Original PAN should also be carried along at the time of submission.

The big four and some other banks have established Customer Advocates as an alternative to EDR. Mint Money looks at the basic steps while gearing up to fight it out against a bank in a court. I recently cashed a check from my insurance agencie and deposited the money into my account.

Where to File a Consumer Complaint About a Bank. Consumer Financial Protection Bureau. If you are the victim of a financial scam credit card scam or identity theft contact your bank immediately.

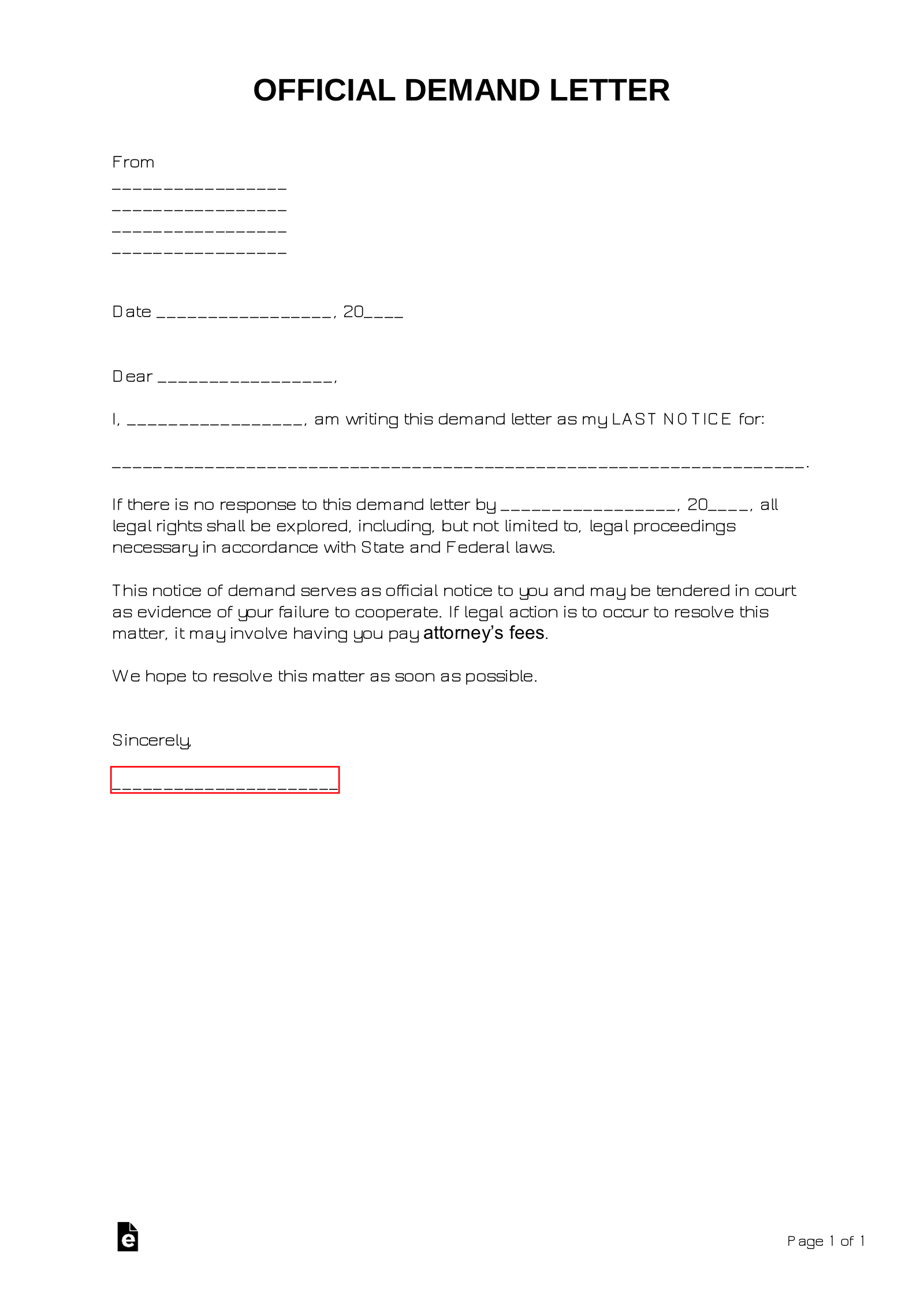

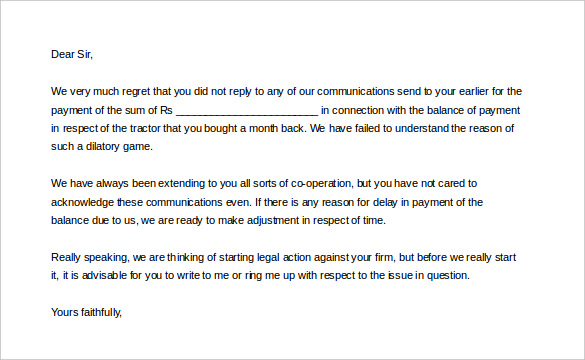

In general a demand letter must include why the payment or action is demanded what are the consequences for non-payment. Send a demand letter to the bank. Court action can be initiated by filling out an N1 form online at moneyclaimgovuk.

You could be the victim as an individual group of people company or other organisation. Whether this second tier of internal. Banks also provide an online method to carry out this procedure.

Telemarketers usually purchase leads lists through legal businesses that sell them. Manage a phone bank. SA customers can now easily take legal action against banks Published Date.

If a call does not resolve things send a letter. Get access to Americas phone network. July 18 2020 South Africas Competition Commission on Friday said some of countrys biggest banks have agreed to remove clauses that precluded their conveyancing firms from representing said banks clients in legal action brought against them.

But they can help you if you are bringing a claim. RBI allows banks to take action against guarantors of wilful defaulters Where guarantees provided by group companies for their defaulting units are not honoured banks are free to classify the. These can also be collected from local courts or downloaded at.

If you are a customer of the Bank an not satisfied with the services of the Bank then you can take legal action either by approaching Bank Ombudsman or by filing a comoplaint before Consumer Disputes Redressal Forum. Your State Attorney Generals Office. A modest claim say for 100 or 200 will mean that you risk a.

Contact the bank or service you sent money through. Prepare to take legal action against the bank Start collecting the required documents which will help make the case of an individual stronger. They said its because my car needs repairs to the body so they are gonna take the money and use it to repair my car.

Two weeks later the bank put a hold on the funds in my account. Written proofs are essential in such cases. Lodge a dispute with the Internal Dispute Resolution IDR team at the bank or other FSP via its website and include any supporting documents you think are relevant.

A call to the financial provider should be your first action but make sure you have all the correct documents with you when you phone. Federal Reserve Consumer Help. Consumers have the right to fight it out in court if there is any dispute.

Many small claims courts require you to make an effort to resolve your dispute before you file a lawsuit in court.

How You Can Benefit From Oft S Recent Legal Action Against Banks Credit Card Claims

How You Can Benefit From Oft S Recent Legal Action Against Banks Credit Card Claims

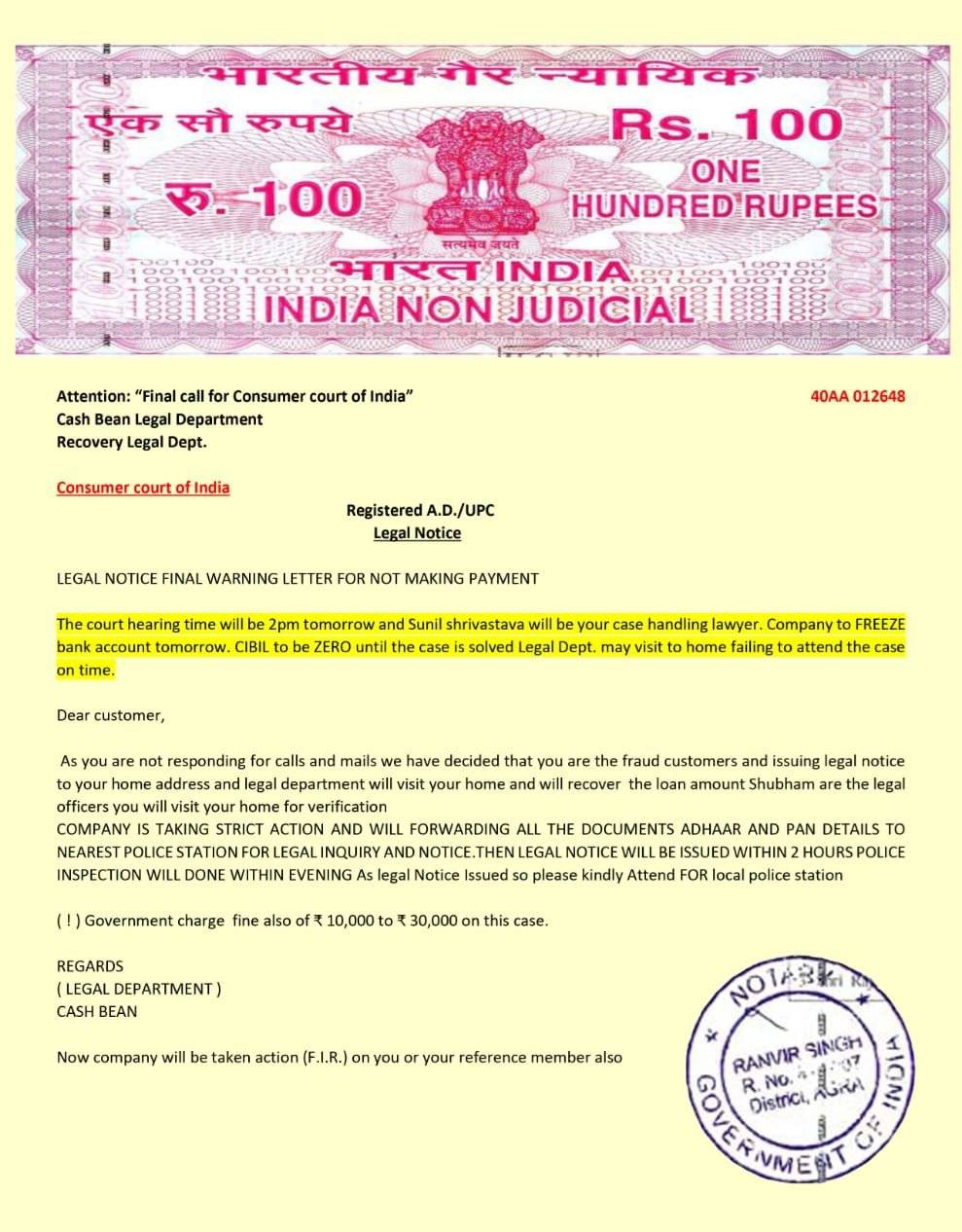

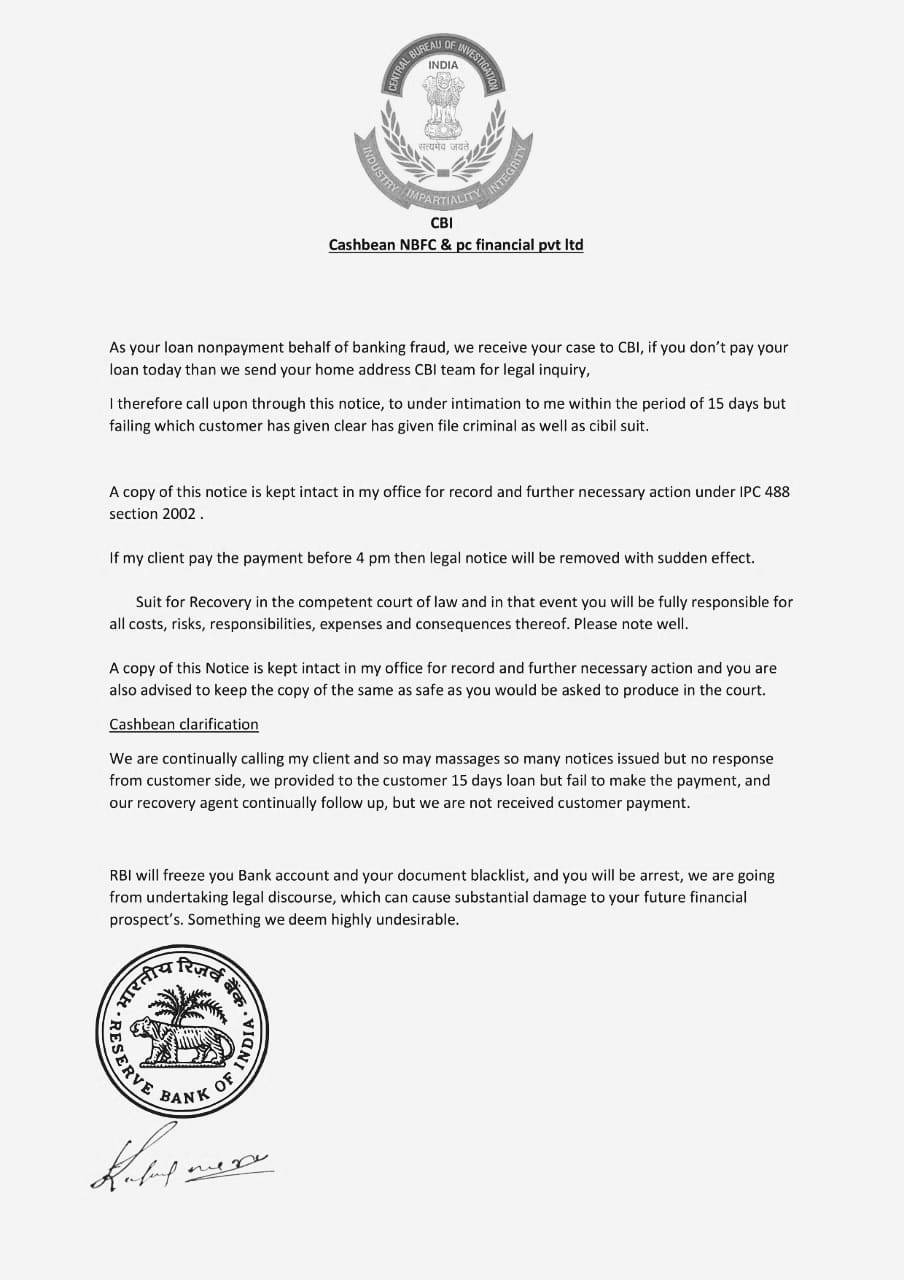

9 Legal Letter Templates Free Sample Example Format Download Free Premium Templates

9 Legal Letter Templates Free Sample Example Format Download Free Premium Templates

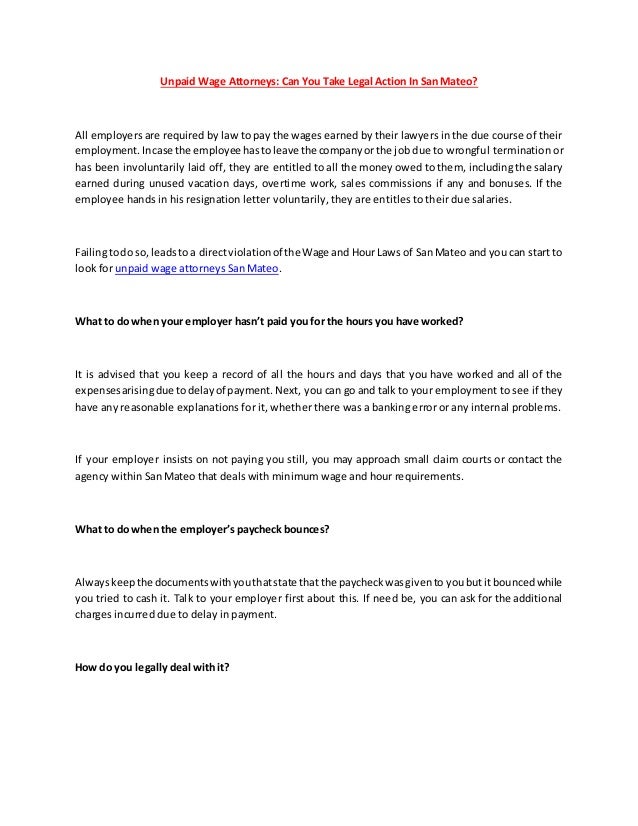

Unpaid Wage Attorneys Can You Take Legal Action In San Mateo

Unpaid Wage Attorneys Can You Take Legal Action In San Mateo

Sustainable Finance European Banking Authority

Sustainable Finance European Banking Authority

Gdpr What Is It And How Does It Impact My Business

Gdpr What Is It And How Does It Impact My Business

Free Demand Letter Templates All Types With Samples Word Pdf Eforms

Free Demand Letter Templates All Types With Samples Word Pdf Eforms

Who Can Sue The Ecb And How Germany News And In Depth Reporting From Berlin And Beyond Dw 09 09 2012

Who Can Sue The Ecb And How Germany News And In Depth Reporting From Berlin And Beyond Dw 09 09 2012

Debt Tales The Bank And You August 2014

Debt Tales The Bank And You August 2014

Filing A Consumer Complaint Usagov

Filing A Consumer Complaint Usagov

9 Legal Letter Templates Free Sample Example Format Download Free Premium Templates

9 Legal Letter Templates Free Sample Example Format Download Free Premium Templates

/bank-levy-basics-315527_FINAL-5788135a0c274ffc81b9d8d53e44a1bb.gif) What A Bank Levy Is And How It Works

What A Bank Levy Is And How It Works

Comments

Post a Comment