- Get link

- X

- Other Apps

Eagle Micro Finance Bank Limited. The problem may be the availability of their branches in your locality.

How To Borrow Money Online In Nigeria Easily Owogram

How To Borrow Money Online In Nigeria Easily Owogram

They have been around for a while and you can borrow money from them.

Where to borrow money in nigeria. You can lend or borrow money on the FINT platform. With Paylater you can access up to 500000 Naira loan with no collateral. You can get an instant loan anytime directly to your bank account only if you have the QuickCheck App.

Besides that you would also. The list of loan apps in Nigeria below is in no particular order. In Nigeria QuickCheck App is regarded as one of the best loan apps due to their greatly rendered services.

Merits of online loans in Nigeria. For other instant loan providers you do not need an account however. Direct Bridge Nigeria Limited.

Employees can then download the app and fill in the form stating how much they want to borrow. The range of loans they offer spreads from N60000 to N2000000. This company is simply a consumer finance company that usually assist individuals and sometimes homes with reliable loan services and also bureau de change.

Loanspot is one of the online lending platforms in Nigeria that provides users with instant online loans in Nigeria. The entire process of borrowing starts and ends with 561 from any Nigerian network. Page is retail financial services provider based in Lagos Nigeria using Tech to simplify borrowing investing and online payments in Nigeria.

In case you are wondering what happens when you port to another network you can choose to pay using any of the available payment channels. 11 Apps to borrow money online instantly in Nigeria. Non-governmental loan lending organizations online etc.

The following table shows the list of mobile loan codes to get quick cash in Nigeria. No need for collateral in most cases. It includes Nigerian telecommunication companies USSD codes to borrow money in Nigeria.

Online money lending platforms. Employers register on the platform and provide access to staff database to Aella Credit. First you would have to register with what is called the FINT risk assessment with is tagged at 3000 naira which would make you eligible to apply for a loan on the platform.

As you can see FBN Micro Finance Limited is owned and operated by First Bank of Nigeria PLC. Paylater is an easy and entirely online lending platform that provides short-term loans to individuals and small businesses in Nigeria to help cover unexpected expenses or urgent cash needs. Also you can choose when to pay back 2.

You can access up to 100 000 and you get the loan within 3 minutes. USSD Code for Loans in Nigeria Requirements for Getting Loans Using a USSD Code. Carbon app was formally called the PayLater app when first come into existence.

Fint is a platform where those who lend money can meet those who want to borrow. Page Financials capitalizes on making funds available to people as fast it can get with quick loans of up to N5 million. As easy as the USSD loans are so are the requirements.

Carbon is the number one choice and most popular for most people to borrow money online. They are located in almost all the branches of First Bank nationwide. You can borrow money up to 200000.

The goal of this platform is to make it easier for businesses entrepreneurs and everyday individuals to have access to credit that would enhance the quality of their livelihoods. The attractive 2 of monthly rates and up to 12 months for the repayment make these loans very attractive to customers. Places to Borrow Money Relatively Quick in Nigeria WithWithout Collateral Paylater.

They are in the business to also help people quickly tackle financial. Surefire Ways to Raise Funds for Business in Nigeria 2019. FINT is ranked as part of the 4000 highest-ranking websites on Google Nigeria.

Access to fast reliable and instant funds. It partners with banks mobile network operators and technology companies on a mission to make personal banking services convenient. Carbon is the first on the list of best new loan apps in Nigeria to borrow quick money for either personal or business needs.

Kwikmoney offers both internet-based app and USSD loan options. Microfinance banks with online service feature. It takes 2 to 3 minutes for.

Services that provide borrowing opportunities online in Nigeria. Naturally you need to be operating an account with most banks to get access to their loans through USSD. The service provides loan opportunities for employers and employees.

Paylater is an online money lender that has taken over the market to help people with financial issues. You can borrow money instantly from the CredCentral located 859 Bishop Aboyade Cole street Victoria Island Lagos Nigeria.

11 Loan Apps To Borrow Money Quick In Nigeria Students In Nigeria Development Platform

11 Loan Apps To Borrow Money Quick In Nigeria Students In Nigeria Development Platform

Fresh 11 Mobile Loan Apps In Nigeria 2020 Oasdom

Fresh 11 Mobile Loan Apps In Nigeria 2020 Oasdom

14 Places To Borrow Money Online Instantly In Nigeria Infoguide Nigeria

14 Places To Borrow Money Online Instantly In Nigeria Infoguide Nigeria

Broke See Where To Borrow Collateral Free Loan In Nigeria National Ambassador National Ambassador

Broke See Where To Borrow Collateral Free Loan In Nigeria National Ambassador National Ambassador

Apps To Borrow Money No 1 Student Development Platform In Africa

Apps To Borrow Money No 1 Student Development Platform In Africa

10 Best Loan Apps In Nigeria 2020 For Students The Abusites

10 Best Loan Apps In Nigeria 2020 For Students The Abusites

8 Money Lending Platforms In Nigeria And Their Interest Rates Pulse Nigeria

Latest Top 12 Websites That Gives Quick Loans Without Collateral In Nigeria

Latest Top 12 Websites That Gives Quick Loans Without Collateral In Nigeria

Ranking Top Payday Loan Offers In Nigeria As At Q1 2020 Nairametrics

Ranking Top Payday Loan Offers In Nigeria As At Q1 2020 Nairametrics

6 Places To Borrow Money Online In Nigeria With Without Collateral

6 Places To Borrow Money Online In Nigeria With Without Collateral

Borrow Money In Nigeria Archives Loan35 Blog Tips Tricks To Get Quick Loans In Nigeria

Borrow Money In Nigeria Archives Loan35 Blog Tips Tricks To Get Quick Loans In Nigeria

Best Loan Apps In Nigeria Top 16 Apps For Urgent Loan In 2021 Loanspot

Best Loan Apps In Nigeria Top 16 Apps For Urgent Loan In 2021 Loanspot

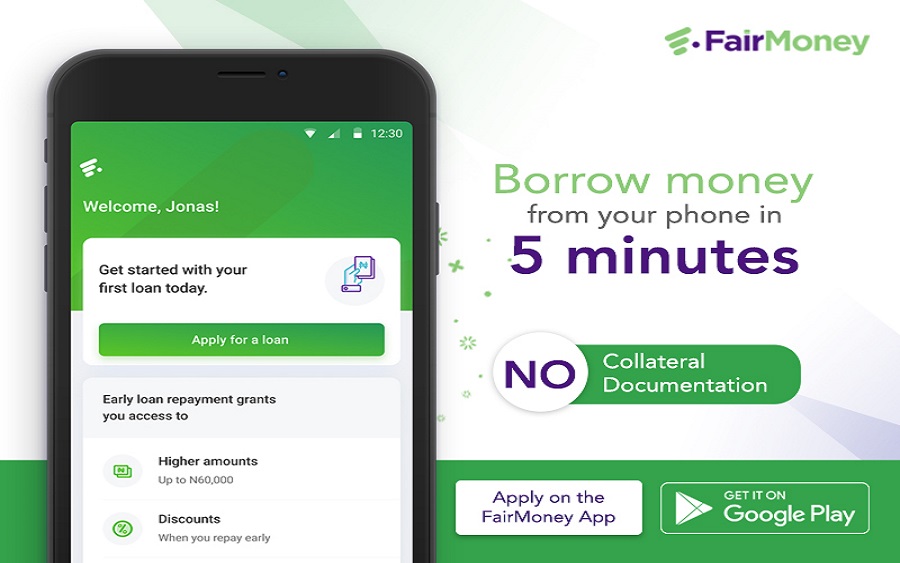

Fairmoney Offers A Different Way To Borrow Money Online Without Collateral

Fairmoney Offers A Different Way To Borrow Money Online Without Collateral

Best Loan Apps In Nigeria 2020 Voguepay

Best Loan Apps In Nigeria 2020 Voguepay

Comments

Post a Comment