- Get link

- X

- Other Apps

On the other hand Openpay might suit you better as it offers more flexibility with your repayments. Does Afterpay Help Your Credit.

Afterpay And Adyen Partner To Deliver Flexible Payments

Afterpay And Adyen Partner To Deliver Flexible Payments

You cant use Afterpay to build your credit history.

Does afterpay build credit. Afterpay also doesnt run a credit check when you sign up which may appeal to buyers whove had credit issues in the past. Afterpay reserves the right to report any negative activity on your Afterpay Account including late payments missed payments defaults or chargebacks to credit reporting agencies This means that your credit score may be affected if you fail to meet repayments. Top Credit Cards for Fair and Average Credit Scores.

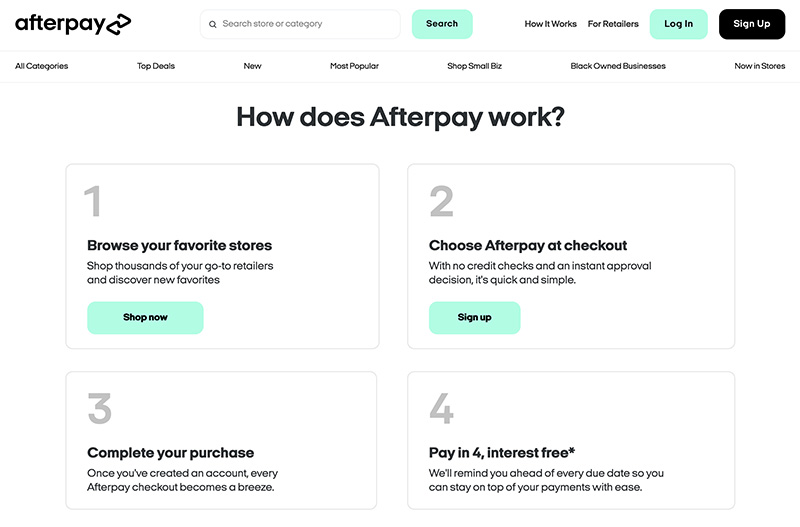

You do have to make regular repayments though and always on time. First-time customers complete a quick registration returning customers simply log in. What is AfterPay and How Does it Work.

And last year alone Afterpay netted 11 million in late payment penalties. The company doesnt pull your credit to approve you for payments either. Set up an Afterpay account either online or via the app.

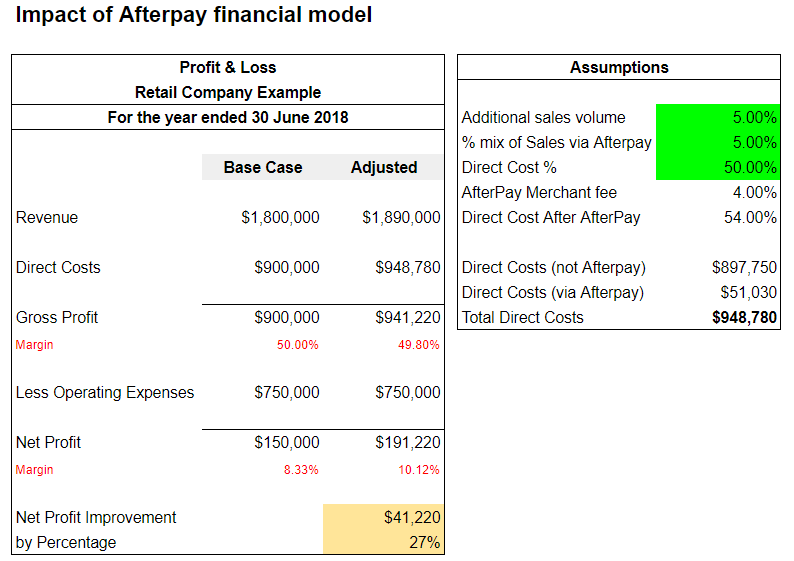

Youll also need to add at least one credit. Afterpay for example doesnt charge interest or other costs to customers although it does charge late-payment fees making up 20 per cent of its revenue. Just like applying for any other forms of credit Afterpay performs a credit check when you sign up for the service.

But these loans come. This means it goes on your credit report as a permanent record for the next 2 years in the same way as if you had applied for a new loan or credit card. Shop as usual then choose Afterpay as your payment method at checkout.

Afterpay partners with more than 25000 retailers providing an alternative to using your credit card. Afterpay and other installment payment services arent lines of credit so you dont need the hard credit check like you would with a credit card but you also dont get the benefit of adding on-time payments to your credit history. The company charges retailers rather than customers.

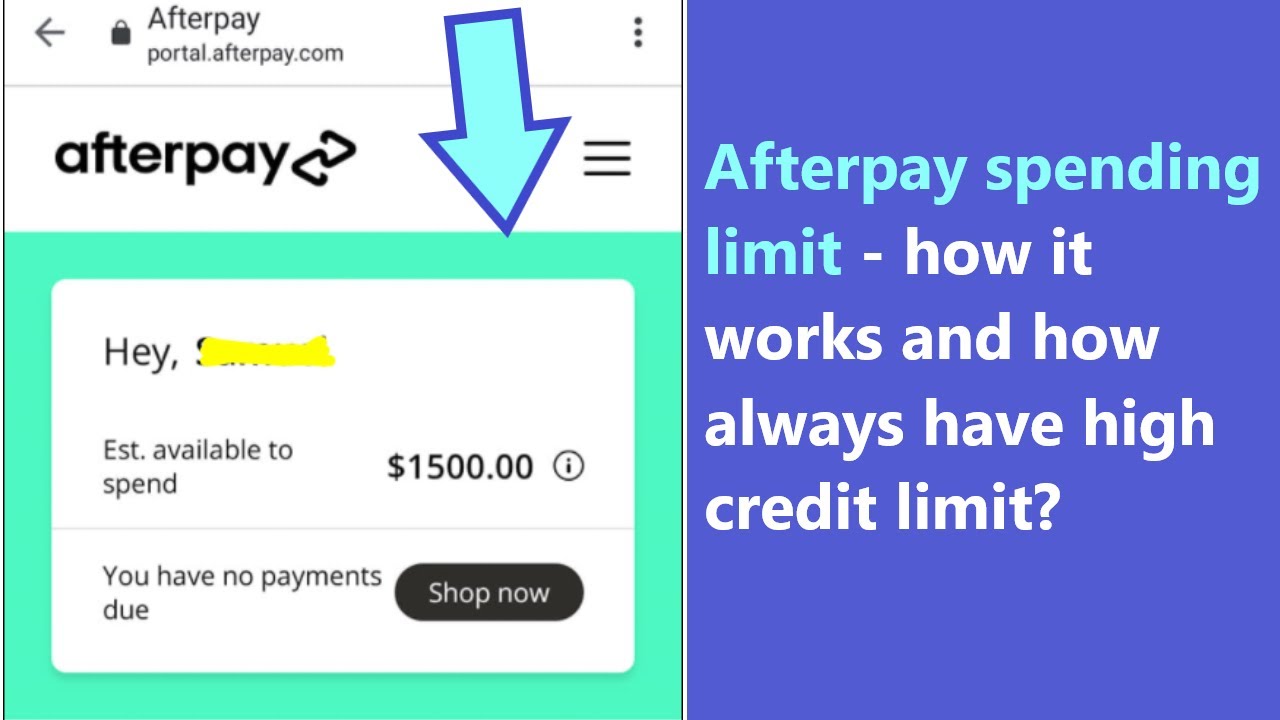

Each time you make a purchase with Afterpay it makes a fresh decision about your spending limit so theres always room for growth. Afterpay is a lender that can help you finance purchases and pay them off over four installment payments without interest. Tips for maximizing Afterpay If Afterpay is still the best payment choice for you follow a few simple tips to.

If you continue to miss payments fees are capped at 25 of the purchase price and you are. When you successfully pay off an Afterpay loan you get a kind of in-house credit and Afterpay will agree to lend you more in the future. Youll provide basic information like your name birthday and address.

Afterpay works like this. Afterpay might be easier to sign up with initially as it doesnt require a credit check when you apply. How are BNPL providers not credit providers.

If you make late payments miss payments or have other issues in maintaining your account Afterpay could report this information to the credit reporting bureaus but thats not the type of credit history you want. Instead of Afterpays schedule of 4 repayments over 8 weeks Openpays repayment plan ranges from 124 months depending on your purchase. In terms of simplicity in the application process Afterpay comes out on top.

There is no credit check before you apply for Afterpay and it wont affect your credit history - as long as you use it responsibly. You must be 19 if. No credit check is required to use AfterPay and no interest is charged.

Article continues below advertisement. The more times you use Afterpay and pay for your purchase successfully the more youll be able to spend. You pay off your products in instalmentsusually fortnightlyand if you miss a payment you get charged a 10 overdue fee.

Does Afterpay run a credit check. Afterpay like Klarna doesnt charge any interest for the four-payment plan. Home does afterpay build your credit does afterpay build your credit.

Credit cards versus Afterpay Winner Afterpay for simplicity but credit cards for building credit history. However Afterpay reserves the right to perform credit checks and to report negative activity on your account which could result in a black mark on your record just like with any other source of credit. A flat fee of 30 cents per.

Users can make weekly payments on items purchased until they are paid in full. Unfortunately making on-time payments with Afterpay does not help your credit. This includes things like late or missed payments defaults or chargebacks.

As long as users pay on time there arent any added fees for using Afterpay. Card providers ask customers to jump through a lot more hoops to. Instead it collects purchase costs on behalf of retailers over four equal fortnightly payments.

Weve all heard of credit scores and most of us understand that they carry weight in the world of finance Read More Follow Us. Unfortunately using Afterpay for purchases doesnt add any details to your credit file when you pay off the account on time. AfterPay is a digital payment platform offered to online shoppers that allows them to delay payments on purchases.

Afterpay does not run a credit check and only charges a fee of 8 if a customer misses a payment. Youll be automatically approved as long as youre 18 and have a working credit or debit card. Afterpay is fully integrated with all your favorite stores.

Bad Credit Wizards Team February 19 2021.

Afterpay Review May 2021 Lifesaver Or Scam Ecommerce Platforms

Afterpay Review May 2021 Lifesaver Or Scam Ecommerce Platforms

Affirm Afterpay And Klarna How Buy Now Pay Later Services Work Real Simple

Affirm Afterpay And Klarna How Buy Now Pay Later Services Work Real Simple

Is Afterpay Worth It Here S What You Need To Know Reviewed

Is Afterpay Worth It Here S What You Need To Know Reviewed

Https Www Haydencapital Com Wp Content Uploads Hayden Captal Apt Presentation Pdf

Afterpay Review May 2021 Lifesaver Or Scam Ecommerce Platforms

Afterpay Review May 2021 Lifesaver Or Scam Ecommerce Platforms

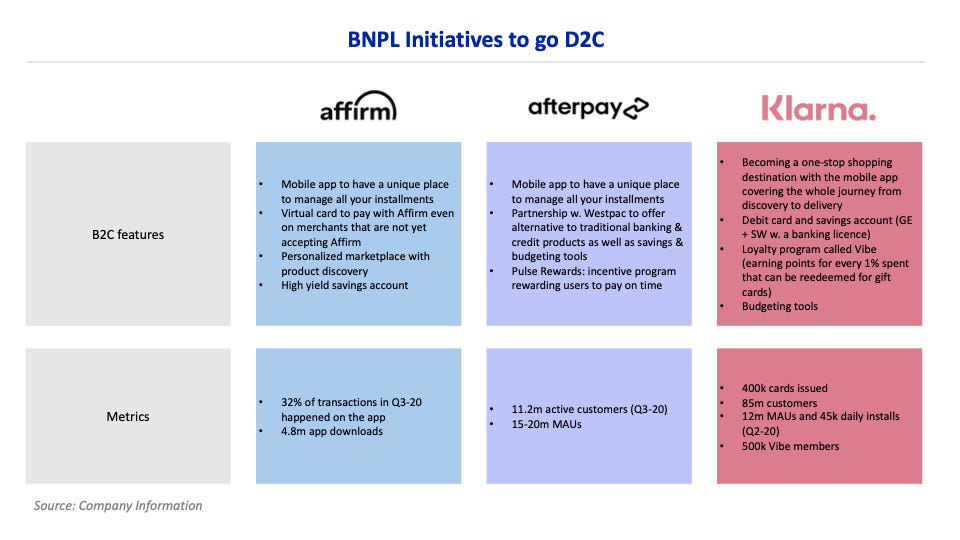

Buy Now Pay Later Solutions Are Going Direct To Consumer

Buy Now Pay Later Solutions Are Going Direct To Consumer

What Is The Max Limit For Afterpay Bill Walters Online

What Is The Max Limit For Afterpay Bill Walters Online

![]() Afterpay Review Should You Shop With Interest Free Payments Mybanktracker

Afterpay Review Should You Shop With Interest Free Payments Mybanktracker

Love Afterpay Here Are The Traps You Should Know About

Love Afterpay Here Are The Traps You Should Know About

Afterpay How It Affects Your Credit Rating And Creates Financial Woes Locations Estate Agents

Afterpay How It Affects Your Credit Rating And Creates Financial Woes Locations Estate Agents

An Alternative To Credit Cards Afterpay Off To Strong Start In Us Market

An Alternative To Credit Cards Afterpay Off To Strong Start In Us Market

Should Your Business Use Afterpay All The Pros And Cons Explained Smartcompany

Should Your Business Use Afterpay All The Pros And Cons Explained Smartcompany

Buy Now Pay Later Working For Afterpay Sharecafe

Comments

Post a Comment