- Get link

- X

- Other Apps

5 reasons to buy an existing small business that is failing 1. You already know what doesnt work.

Starting A Business By Buying An Insolvent Business Cleverism

Starting A Business By Buying An Insolvent Business Cleverism

Never let your ego get in the way.

Buying a failing business. However that is the exception. I do not think any investor in their right mind will be willing to buy a. Allow the buyer to focus on the upside - their notions of unrecognized potential room to reorganize and ways to rebuild.

It may seem counter-intuitive to buy a declining business but if it was once profitable its possible that a new owner could increase its value once again. Buying a business failing or not isnt just about paying the asking price. If your business is failing and youre thinking of selling up its reassuring to know that a market exists for buying businesses with the potential to be turned around.

A great advantage of purchasing a failing business is the lower price point. Make sure you understand what the real cost of buying is and solicit advice from trusted professionals before you jump in with both feet. Dont make excuses and dont confuse the failure of the business with personal.

No business acquisition is risk-free but buying a failing business escalates the odds. Sometimes a failing company might be doing everything right right product identifying the right customer base right pricing but their marketing is not able to convince customers to buy their. Business Buying a failing business Industry veteran Ian Shott moves fast in a bid to turn around a doomed UK.

Work with a broker. Cozy up to CPAs and lawyers. Consider your personal exit strategy in terms of indemnity.

Can You Sell a Failing Business. Its about making a. To find a business.

Point out the value in the business asset. Use the change to give it a shake up Slack says. Identify the problem and solve it.

7 Top Advice to do it Correctly 1. Buying distressed businesses takes a degree of skill and one of the key things you need to consider is why is the business not profitable. What to Consider 1.

Youre likely to need. Buying a business in difficulty is by its nature very risky as the business has already failed and it may well be that much that could be done at this stage has been tried and not worked such as cut costs diversify change management team rebrand new marketing etc etc. You may be limited to buyers with experience in turnarounds.

Accept that you wont get top dollar for a business gone bust. Some people who are trying to unload their failing small businesses are willing to give it up for a price that. By buying an existing business you want to avoid the pitfalls of opening your own shop.

Make the right deal. Do Very Thorough Research I reviewed dozens of struggling companies before making my final decision to buy. Business brokers operate a lot like real estate agents only they help facilitate the sale of businesses.

It is only logical that a buyer would want to be sure of how much a. Heres How To Do It. One thing that I should make clear is that you should proceed with.

If they lost a key manager who was holding the business together then before you buy the distressed business you need a plan in place to replace or improve those processes the business lost. The best you may be able to expect is a fire sale price. Look for a business with a strong customer base growing sales good staff established procedures and most important positive cash flow.

Consider Your Current Financial Position Buying a failing business is a long-term investment. Dont buy a business thats in really bad shape. If you are considering buying an existing business compare that to buying a franchise.

How Much Time Do You Have. Buying a company that isnt producing profit is a risk and it wont ever sell for the same amount as successful companies at a similar size. Advantages of buying a failing business.

Here are four of the top ways to unearth a diamond in the rough. Recognize that the market for a struggling business is small. Contract research site by Alex Scott May 30 2016.

But if you make a conscious decision to learn from your predecessors mistakes youll be less likely to repeat them. While many businesses fail for legitimate reasons sometimes its because the proposition simply isnt viable. Bring the company into the 21st.

Better to pay too much for a good business than to pay too little for a bad business. If a business has current losses and cant be turned around has debt or other liabilities or the seller hopes that the current employees will keep their jobs it is possible the owner might pay you to take over the business or at least allow you to buy the business for less than its liquidation value. Youve bought an enterprise on the brink of collapse and it was failing for a reason.

When observing a small business from as an outside party it is sometimes.

How To Find Buy And Turn Around A Fixer Upper Business

How To Find Buy And Turn Around A Fixer Upper Business

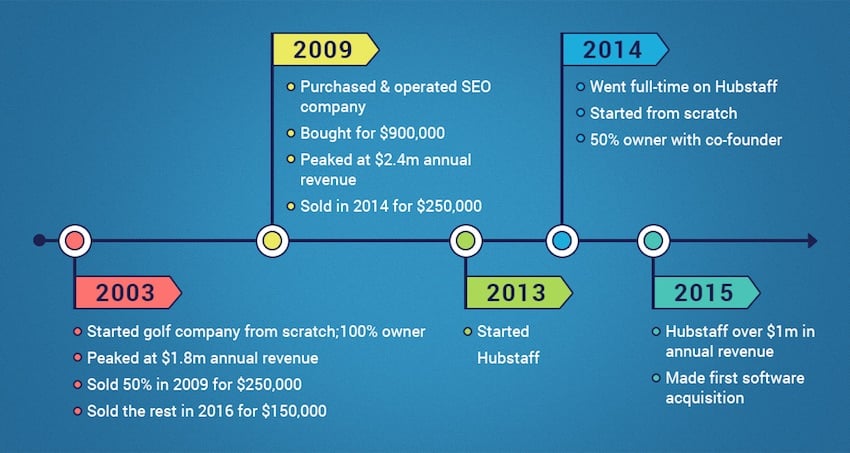

How To Buy And Sell A Business As Told By An Entrepreneur

How To Buy And Sell A Business As Told By An Entrepreneur

How To Buy And Sell A Business As Told By An Entrepreneur

How To Buy And Sell A Business As Told By An Entrepreneur

Would Someone Buy A Failing Business That Was Once Profitable Selling My Business

Would Someone Buy A Failing Business That Was Once Profitable Selling My Business

Starting A Business By Buying An Insolvent Business Cleverism

Starting A Business By Buying An Insolvent Business Cleverism

Adam Jacobs On Buying Failing Businesses And Turning Them Around Absolute Baller

Adam Jacobs On Buying Failing Businesses And Turning Them Around Absolute Baller

5 Frequent Mistakes When Buying A Small Business

5 Frequent Mistakes When Buying A Small Business

How To Buy A Failing Company At A Bargain Price

How To Buy A Failing Company At A Bargain Price

Four Reasons Why You Should Consider Buying A Failing Business

Four Reasons Why You Should Consider Buying A Failing Business

Make Money From Buying A Failing Business Here S How To Do It Take It Personel Ly

Make Money From Buying A Failing Business Here S How To Do It Take It Personel Ly

Make Money From Buying A Failing Business Here S How To Do It Take It Personel Ly

Make Money From Buying A Failing Business Here S How To Do It Take It Personel Ly

Buying A Distressed Business A Winning Strategy

Buying A Distressed Business A Winning Strategy

Comments

Post a Comment